If you have ever waited at a clinic only to hear a needed medicine is out of stock, you know how fragile access can be. The United States has unveiled a refreshed global health strategy that puts reliable, affordable medicines at the center and pairs that goal with a push for greater autonomy in partner countries’ health systems. The plan moves away from perpetual aid and commodity donations toward market-shaping, local production, shared financing, and stronger regulatory systems that can stand on their own.

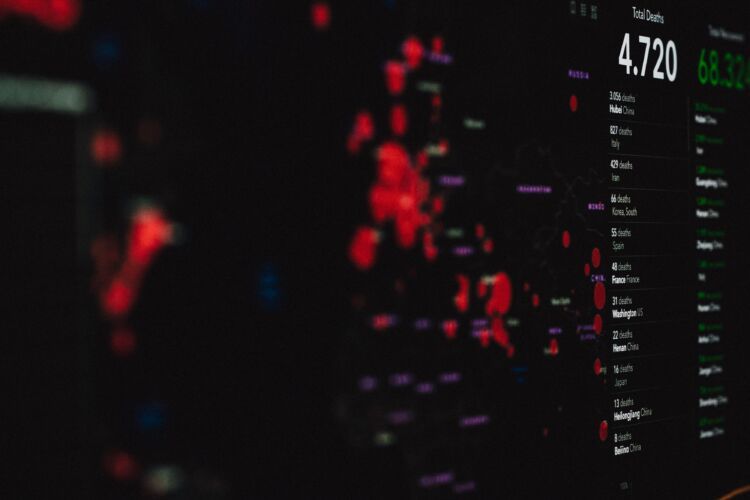

The rationale is hard to ignore. The World Health Organization reports that more than 90 countries saw disruptions to essential health services during the pandemic, while an estimated 2 billion people still lack regular access to essential medicines. Noncommunicable diseases now account for roughly 74 percent of global deaths, and antimicrobial resistance was directly responsible for about 1.27 million deaths in 2019. Donor budgets are tight, and supply chains have become a geopolitical issue, which adds urgency to diversify manufacturing and secure regional access.

Access to Medicines and Diagnostics Comes First

At the heart of the strategy is broader access to high-impact treatments for HIV, TB, malaria, maternal and child health, and priority conditions like hypertension and diabetes. The plan promotes quality-assured generics and biosimilars, using tools such as pooled procurement, price transparency, and negotiated tiered pricing to lower costs. It also links medicines to the diagnostics and devices that guide safe use, from viral load tests to glucose monitors, so prescribing is timely and appropriate.

Building Self-Reliance in Partner Countries

Washington aims to help countries develop domestic and regional manufacturing capacity through technology transfer, workforce training, and Good Manufacturing Practice compliance. National medicines regulators and pharmacovigilance systems will be strengthened, along with regional regulatory harmonization that can speed approvals without compromising safety. On the delivery side, the plan invests in forecasting, warehousing, last-mile distribution, and cold chain where needed. Co-financing and budget integration will be embedded through medium-term transition roadmaps that reduce reliance on donor funds.

Guarding Quality and Market Integrity

To tackle substandard and falsified products, the strategy backs surveillance, track-and-trace tools, and enforcement partnerships. It supports standardized essential medicines lists and clinical guidelines so procurement aligns with evidence-based care. Expanded quality assurance and product prequalification are designed to raise the bar for manufacturers and give buyers confidence.

Preparedness, Digital Data, and Equity

Preparedness features include regional surge manufacturing and emergency stockpiles for critical medicines when outbreaks hit. Interoperable logistics information systems will provide visibility from central stores to clinics, using real-time data to prevent stockouts, cut waste, and monitor treatment outcomes. Equity is a throughline, with priority for women, children, marginalized groups, conflict-affected populations, and remote communities. The plan also encourages insurance subsidies, voucher programs, or fee removal to reduce financial barriers at the point of care.

Tackling AMR and Climate Risks

The antimicrobial resistance agenda pairs better access to antibiotics with stewardship, rapid diagnostics, and surveillance to preserve effectiveness. Research and development incentives for priority antimicrobials are on the table, coupled with safeguards to keep new products affordable. Climate resilience shows up in temperature-stable formulations, renewable-powered storage, and supply chains built to withstand extreme weather.

How the United States Will Deliver

USAID will lead country programs, supply chain strengthening, and local capacity development. HHS, CDC, and FDA will support surveillance, regulatory science collaboration, and pharmacovigilance, with AMR stewardship as a focus. State Department platforms such as PEPFAR and PMI will sustain access for disease programs and guide transition planning. The U.S. International Development Finance Corporation and the Commerce Department will help crowd in investment, blended finance, and trade support for health manufacturing.

Partnerships are central. The strategy aligns financing and regulatory harmonization with WHO, the Global Fund, Gavi, Unitaid, the World Bank, and regional development banks. It will engage the Medicines Patent Pool and voluntary licensing to expand access while respecting innovation, and work with African, Asian, and Latin American initiatives on regional manufacturing hubs and pooled procurement.

Financing That Shapes Markets

To de-risk local production, the plan envisions advance market commitments, volume guarantees, and milestone-based grants. Pooled procurement and transparent price benchmarks aim to sharpen competition and reduce costs. Country co-investment and domestic resource mobilization will be tied to measurable reforms, aligning incentives on all sides.

What Sets This Plan Apart

Compared with prior approaches, the strategy relies less on donations and more on sustainable markets, local industry, and shared financing. It reaches beyond a handful of vertical programs to integrate medicines access into primary care. There is a stronger emphasis on quality assurance, regulatory capacity, and data-driven logistics to prevent stockouts and counterfeits. Structured graduation pathways establish clear expectations for transition without sudden funding cliffs.

Early Moves and Pilot Projects

Initial actions will include regional manufacturing pilots for high-demand generics and select biologics, end-to-end supply chain digitization in chosen countries, and regulatory twinning that pairs U.S. agencies with national regulators to accelerate approvals and improve post-market safety monitoring.

Benefits and Real-World Risks

If it works, prices should fall and access should stabilize, with faster responses to outbreaks and fewer treatment interruptions. Stronger domestic financing and local production can reduce long-term dependency while improving equity. Risks remain, including scaling manufacturing without sacrificing quality, managing intellectual property and technology transfer, and ensuring fiscal sustainability for partner countries. The plan also must balance spending on medicines with investments in prevention and the health workforce, and safeguard antibiotic stewardship as access grows.

How Progress Will Be Tracked

Expect dashboards that show facility-level availability and stockout rates, price trends for priority products, regulatory approval timelines, and pharmacovigilance reporting. Policymakers will watch the share of procurement sourced locally or regionally, along with progress on co-financing commitments and transition milestones.

What Happens Next

Near term steps include launching pilots, setting country compacts with clear milestones, initiating regulatory partnerships, and publishing price and availability data. Medium term goals are to expand regional manufacturing hubs, scale pooled procurement, and integrate financing into national budgets. Periodic reviews tied to funding tranches will adjust course and keep accountability front and center.