As cooler weather returns, many households are already asking the same question: will this fall and winter be better, worse, or about the same for respiratory viruses? The best current read is cautiously steady. Experts expect the peak combined weekly hospitalizations from COVID-19, influenza, and RSV to be similar to last season, within about 20 percent either way. Multiple peaks are possible, and total strain across the full season still matters, but the headline outlook points to a familiar level of pressure. This is a high-level, uncertainty-aware assessment that will be refreshed about every two months as new signals emerge.

Headline outlook for hospital burden

Recent seasons have delivered surprises in timing and regional patterns, yet the national combined peak across the past three years has been relatively stable. Expert elicitation, historical surveillance, and modeling converge on a most-likely scenario that mirrors last year’s crest. Confidence is limited to moderate because timing and overlap can amplify stress even if peak size is similar. Health systems should plan for a comparable peak, with contingency for a higher one if events stack or a new COVID-19 variant alters the trajectory. Remember that cumulative hospitalizations across months can strain operations even without a single towering peak.

Key uncertainties that could raise the peak

The biggest swing factor is overlap. If COVID-19, influenza, and RSV crest together in more regions at the same time, hospital load can rise quickly. Variant dynamics matter too. A SARS-CoV-2 variant with greater immune escape could push COVID-19 admissions higher, particularly where vaccine uptake lags or protection has waned. Regional differences by HHS region, including earlier RSV peaks in the Southeast compared with northern and western areas, will shape who feels pressure first.

What timing to expect

If national patterns hold, COVID-19 tends to peak in late December or early January. Influenza peaks often arrive between December and February, with substantial year-to-year swings. RSV usually peaks nationally in late December or early January, with earlier activity in parts of the Southeast. Some degree of overlap is anticipated, and it is reasonable to plan for more than one combined wave. That means preparedness should not hinge on a single week but instead on a flexible window from late December through February.

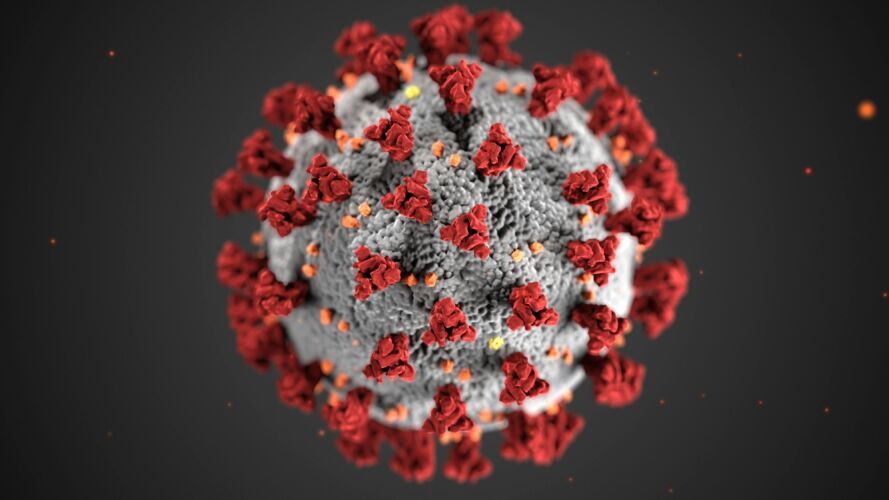

COVID-19 outlook

The weekly hospitalization peak is expected to be similar to or higher than last season, with moderate confidence. A large summer 2024 wave likely boosted immunity ahead of last winter, which helped keep the 2024 to 2025 peak in check. As of August 19, 2025, national COVID-19 hospitalization rates sit below this point in prior years but are rising in many areas. Models suggest a national winter peak in January under both primary scenarios, with vaccine uptake and effectiveness similar to last season and concentrated among higher-risk adults. Without a new moderately immune-evading variant, the projected peak ranges from about 3.8 to 5.9 hospitalizations per 100,000 people, and a higher winter burden than last year is still plausible due to waning protection. If a variant with moderate immune escape emerges in the fall, with introduction modeled in November, the projected peak rises to about 6.7 to 9.5 per 100,000, with a brief rise and fall in exposure risk. Independent modeling consortia anticipate two periods of increased COVID-19 activity, one in late August 2025 and another in January 2026.

Influenza outlook

Influenza severity is likely to be moderate across all ages based on historical patterns and expert opinion. The 2024 to 2025 season reached high severity across all ages, the first since 2017 to 2018, which is unusual to see in back-to-back years at the national level. Age-specific high severity remains possible. Vaccination remains the strongest lever. Last season, influenza vaccination was estimated to avert roughly 240,000 hospitalizations, primarily among adults 65 and older, although uptake and vaccine match are still uncertain for this season.

RSV outlook

RSV peak hospitalizations across all ages are expected to be similar to last season, within about 20 percent, with moderate confidence. The immunization landscape continues to evolve. For infants, a monoclonal antibody and maternal RSV vaccination were introduced in 2023 and are expected to see increasing uptake. During 2024 to 2025, RSV hospitalization rates among infants under 8 months were 28 percent and 43 percent lower in two surveillance networks compared with pre-pandemic seasons. For adults, a single lifetime RSV vaccine dose is recommended for those 75 and older and for adults 50 to 74 with certain high-risk conditions. Coverage among those 75 and older rose from 28.8 percent to 47.5 percent over the 2024 to 2025 season, though additional uptake this season is unclear, and effectiveness is expected to wane over time since vaccination.

What this means for preparedness

Plan for a combined peak similar to last year and be ready for more if peaks overlap or a new COVID-19 variant emerges. Build surge capacity for staffing, inpatient and ICU beds, and supplies across late December through February, while watching for regional asynchrony that could shift demand earlier or later. Promote timely vaccination and immunization for COVID-19, influenza, and RSV, especially in older adults and those with underlying conditions. Local monitoring should drive local action since regional timing varies.

How this outlook was built

This assessment draws on historical surveillance for COVID-19, influenza, and RSV, hospital patterns from RESP-NET, and expert input from 20 specialists in epidemiology, modeling, surveillance, and risk analysis, including Insight Net participants. The expert elicitation process was co-developed with Metaculus to quantify expectations and uncertainty that then helped shape modeling inputs. For COVID-19, an age-structured model incorporates infection and vaccination histories, waning protection, and strain-specific immunity under two variant scenarios. External consortia, including the COVID-19 Scenario Modeling Hub, anticipate two activity peaks that align with this outlook. This is not a point forecast, but a planning guide designed to be updated.

Confidence and what could change

Overall confidence is low to moderate. The outlook prioritizes peak burden and may not fully capture cumulative strain, and regional heterogeneity can diverge from national patterns. Assumptions about variant emergence, vaccine uptake, and effectiveness may shift. Expect updates roughly every two months or as conditions warrant so that plans can adapt to new evidence.